Aug 11, 2025 • 8 min read

California’s Climate Disclosure Laws Are Here: What SB 261 and SB 253 Mean for Your Business

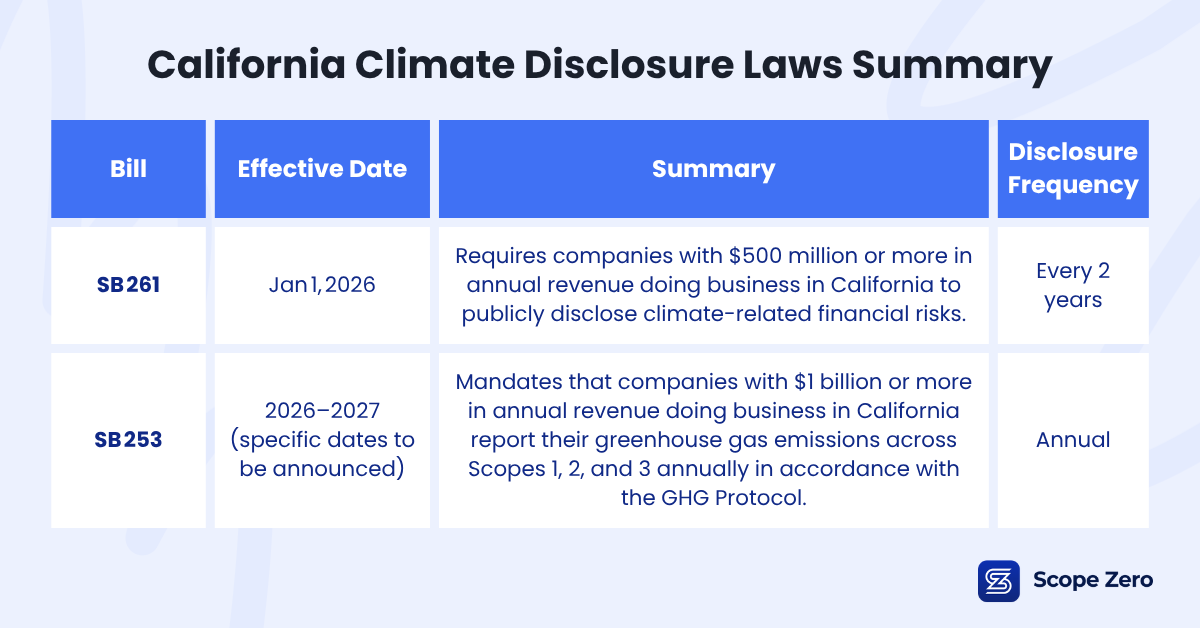

California has taken a step forward in corporate climate accountability with the passage of two bills in 2023: SB 261 and SB 253. Together, they fundamentally change how businesses must approach climate risk assessment and greenhouse gas emissions reporting.

If your company operates in California and meets specific revenue thresholds, these laws will soon require you to measure, report, and actively mitigate climate impacts.

Table of Contents

Summary of California’s new climate disclosure laws

SB 261: Climate-Related Financial Risk Disclosure

SB 261 requires qualifying companies to publicly disclose climate-related financial risks. With the first report due by January 1, 2026, now is the time to evaluate how your company manages, mitigates, and reports on climate risks.

Who must comply

SB 261 applies to companies that meet two key criteria:

- Geographic scope: Conduct business operations in California

- Revenue threshold: Generate annual revenues of $500 million or more

This broad definition captures not only California-based companies but also out-of-state businesses with sizable California operations, potentially affecting thousands of enterprises across various industries.

The California Air Resources Board (CARB) is currently leaning on definitions from the state’s Franchise Tax Code, which considers a company to be “doing business” in California if it engages in transactions for profit and meets certain thresholds, such as having over $735,000 in in-state sales, more than $73,000 in property or payroll in the state, or 25% of total business activity tied to California. However, CARB has stated that these thresholds may evolve through the rulemaking process.

Core requirements

Under SB 261, covered companies must produce comprehensive public reports that address climate-related financial risks through a structured framework. These reports must be prominently posted on company websites and include detailed information across four critical areas:

Governance: How your organization's leadership oversees climate-related risks and opportunities, including board-level oversight, roles and responsibilities, and decision-making processes.

Strategy: The actual and potential impacts of climate-related risks and opportunities on your business, strategy, and financial planning.

Risk management: Your processes for identifying, assessing, and managing climate-related risks, and how these integrate with overall risk management systems.

Metrics and targets: The specific metrics and targets used to assess and manage relevant climate-related risks and opportunities, including progress against established goals.

CARB has provided guidance for companies to align with established reporting frameworks such as TCFD or IFRS S2.

Implementation timeline

- First report deadline: January 1, 2026

- Ongoing reporting: Every two years thereafter

- Preparation period: Companies should begin assessment and data collection processes immediately to meet the initial deadline

Companies must publish their first climate-related financial risk report by January 1, 2026, using data from either FY 2023/2024 or FY 2024/2025, depending on availability. While these requirements reflect current statutes and CARB’s preliminary guidance, final regulations may evolve. CARB has emphasized a flexible approach for first-time reporters, providing a practical starting point for companies to build the systems and infrastructure needed for compliance.

SB 253: Climate Corporate Data Accountability Act

SB 253 requires qualifying companies to report their greenhouse gas emissions annually across all three scopes following the GHG Protocol. Scope 1 and 2 disclosures begin in 2026, with scope 3 following in 2027. Final disclosure deadlines will be announced at a later date.

Who must comply

SB 253 applies to companies that meet the following criteria:

- Geographic scope: Conduct business operations in California

- Revenue threshold: Generate annual revenues of $1 billion or more

Similar to SB 261, CARB’s definition of companies conducting business in California is still being finalized as of August 2025.

Core requirements

SB 253 requires annual greenhouse gas emissions reporting across all three scopes of the internationally recognized GHG Protocol:

Scope 1 (Direct Emissions): Emissions from sources directly owned or controlled by your company, including on-site fuel combustion, company vehicles, and manufacturing processes.

Scope 2 (Indirect Energy Emissions): Emissions from purchased electricity, steam, heating, and cooling consumed by your company.

Scope 3 (Value Chain Emissions): All other indirect emissions that occur throughout your value chain, including employee commuting, business travel, purchased goods and services, and product lifecycle emissions.

Implementation timelines

- Scope 1 & 2 reporting: 2026 (specific date to be announced; based on 2025 data collection)

- Scope 3 reporting: 2027 (based on 2026 data collection)

- Ongoing requirements: Annual reporting thereafter

Health and Safety Code § 38532 requires that Scope 1 and 2 emissions be publicly disclosed starting in 2026, by a date determined by CARB, for the reporting entity’s prior fiscal year. The statute states that companies covered under § 38532 will be required to obtain an assurance (or verification) engagement performed by an independent third-party assurance provider for their Scope 1 and 2 emissions at a limited-assurance level beginning in 2026, and at a reasonable-assurance level beginning in 2030.

The current state of regulations

As of August 2025, while the statutory requirements of SB 253 and SB 261 are in effect, detailed regulations, including definitions (e.g., “doing business in California”), reporting timelines, and technical compliance requirements are still being finalized. CARB has released draft guidance, hosted public workshops, and published FAQs to help companies prepare. The first SB 261 risk reports are still due by January 1, 2026, and SB 253 Scope 1 and 2 reports will follow later in 2026.

What might change

While the core obligations under SB 253 and SB 261 remain intact, several elements are still in flux:

- Definitions of “doing business in California” and “total annual revenue” are not yet finalized. CARB is currently referencing Franchise Tax Board thresholds but may adjust these during rulemaking.

- The reporting format, submission process, and third-party verification standards for emissions disclosures are still being developed and will be shaped through public comment.

- Requirements for independent verification of Scope 1 and 2 emissions are expected to phase in starting in 2026, with stricter standards by 2030. Exact timing and procedures will be finalized through CARB’s rulemaking process.

- Draft regulations are expected by the end of 2025, following additional public workshops and stakeholder input sessions.

Companies should prepare to comply with existing statutory deadlines while remaining agile in anticipation of final regulatory language.

Immediate steps businesses should take to be ready

The timeline for compliance is shorter than many companies realize. With CARB rules due before the end of 2025 and first reports required by early 2026, successful preparation requires immediate action:

- Conduct gap analysis: Assess current climate risk management and emissions measurement capabilities against regulatory requirements.

- Establish data systems: Implement robust data collection and management systems, particularly for challenging scope 3 categories.

- Engage stakeholders: Build internal support and expertise across legal, sustainability, finance, and operations teams.

Consider strategic solutions: Evaluate tools and partnerships that can accelerate compliance while creating additional business value.

How the Carbon Savings Account® addresses California's climate disclosure requirements

Scope Zero's Carbon Savings Account® (CSA) represents a strategic solution that transforms employee engagement into positive climate compliance outcomes. This innovative employee benefit empowers individuals to reduce their home and transportation-related emissions while providing companies with the data, documentation, and demonstrated progress necessary to meet both SB 261 and SB 253 requirements.

Supporting SB 261 risk disclosure requirements

The CSA strengthens your reporting across all four framework pillars by helping you:

- Identify and quantify scope 3 climate risks: Unlock access to real-time data on employee commuting and home energy use.

- Demonstrate mitigation strategies: Incentivize energy-efficient upgrades that directly reduce scope 3, category 7 emissions.

- Show governance and stakeholder engagement: Demonstrate you’re embedding climate action into company-wide strategy.

The platform generates the documentation necessary to support robust risk disclosure narratives. For example, companies can include language such as:

"To address identified risks from scope 3, category 7 emissions related to our hybrid work model, we implemented the Carbon Savings Account®, which empowers employees to reduce personal emissions through home efficiency and commuting upgrades while providing detailed operational climate risk data.”

Supporting SB 253 emissions reporting requirements

The CSA directly addresses one of the most challenging aspects of scope 3 compliance: accurately measuring and influencing employee-driven emissions, particularly in category 7 of the GHG Protocol.

The CSA provides:

- Standardized data collection: Establish consistent methodologies for tracking employee carbon footprints across diverse workforce segments for scope 3, category 7 reporting.

- Transparent emissions metrics: Report emissions reductions tied directly to verified employee behaviors and actions, providing concrete evidence of organizational climate impact.

- Verifiable reduction activity: Claim specific, measurable emissions reductions in their annual SB 253 reports.

The CSA enables companies to report concrete outcomes with confidence. For example, a company could see reportable results such as:

"Through the Carbon Savings Account® program, 38% of employees enrolled and achieved measurable reductions in both commuting and home energy emissions through electric vehicle adoption and efficiency upgrades, resulting in scope 3, category 7 emissions reductions of 613 metric tons of CO₂e.”

Beyond compliance: Creating a competitive advantage

California's climate disclosure laws represent more than regulatory requirements — they signal a fundamental shift toward transparency-driven climate accountability that will likely influence federal policy and other state legislation. Companies that view these requirements as mere compliance exercises miss the strategic opportunity to build competitive advantages through early action.

Market differentiation: Early compliance demonstrates climate leadership to customers, investors, and partners who increasingly prioritize environmental responsibility in business relationships.

Risk management: Proactive climate risk assessment and mitigation reduce exposure to physical climate impacts, transition risks, and regulatory uncertainties.

Employee engagement: Programs like the CSA transform climate compliance from a corporate burden into an employee benefit, improving retention and attraction in competitive talent markets.

Operational efficiency: Systematic emissions measurement often reveals cost-saving opportunities through energy efficiency and process optimization.

Take the next step in future-proofing your climate strategy

California’s climate laws are reshaping how companies must account for risk and emissions. Meeting SB 253 and SB 261 requirements isn’t just about checking a compliance box; it’s about building long-term resilience, operational efficiency, and stakeholder trust.

The CSA offers an effective, data-backed way to address scope 3 emissions, demonstrate proactive climate risk management, and engage your workforce in meaningful action. Schedule a demo to see how the CSA can transform your approach to ESG compliance and unlock environmental and financial impact for your business.

Join our community

Sign up for our newsletter to stay up-to-date on all things Scope Zero.

Platform

Platform