Oct 4, 2024 • 4 min read

ESG Score: What It Is and Why It Matters

Business operations require constant measurement, metrics, and calculations to foster progress. This is definitely the case when it comes to an ESG strategy. If you’re looking to make progress within your organization’s ESG strategy, knowing and understanding how an ESG score works is all part of the process.

For those organizations looking to find qualified investors or maintain compliance with local laws, improving your ESG score can help you get there. In this article, you’ll find important information related to an ESG score, what it measures, and how stakeholders use it to analyze business operations.

Table of Contents

What is an ESG Score?

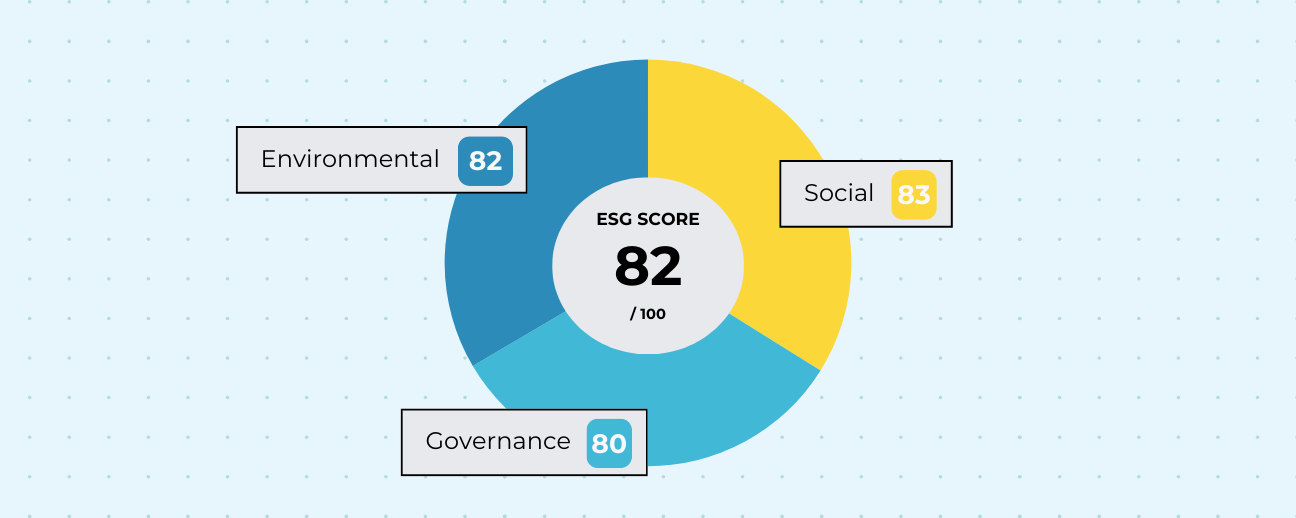

The acronym ESG stands for environmental, social, and governance. An ESG score is a metric used to quantify an organization’s performance in these three pillars.

ESG scores are used by business leaders, investors, and other key stakeholders to ensure that businesses meet ESG standards set by strategy or legislation. Many organizations hire third-party raters, such as MSCI, Sustainalytics, and LSEG Data & Analytics to help calculate an organization’s ESG score.

ESG scores help to translate large swaths of ESG data into more digestible metrics for stakeholders. ESG scores are not intended to replace more in-depth and specific metrics around environmental, social and governance efforts, but ESG scores are used to complement those specific metrics to help craft a more well-rounded picture of an organization’s performance.

What Do ESG Scores Measure?

Within the three main pillars of an ESG strategy, rating agencies analyze a handful of different metrics to evaluate organizations. Below are a few examples.

Environmental Metrics:

- Carbon emissions

- Energy efficiency

- Water usage

- Waste management

- Biodiversity impact

- Pollution prevention

Social Metrics:

- Labor practices and human rights

- Employee engagement and satisfaction

- Customer satisfaction and product safety

- Community relations and impact

- Supply chain management

- Data privacy and security

Governance Metrics:

- Board composition and diversity

- Executive compensation

- Shareholder rights

- Corporate governance policies

- Ethical business practices

- Risk management

What is a “Good” ESG Score?

Typical ESG scores range between 0 to 100. Scores below 50 are considered poor, while anything above 70 is considered good. It’s important to note that ESG scores are not standardized across reporting organizations. A score provided by one reporting agency may weigh the environmental metrics more heavily than another, skewing the score.

Because of these variations, ESG scores will vary depending on the reporting agency the organization chooses to partner with. The variety in scoring methodologies makes ESG scores a good starting point for long-term strategy. ESG scores are meant to provide a high-level overview of ESG strategies as a whole instead of specific details and metrics.

ESG Rating Agencies and Methodologies

ESG rating agencies are responsible for creating an ESG scoring system and analyzing organizations using the scoring system they created. Most organizations use the 0 to 100 scoring system, but some will create their own method of reporting.

ESG scores are not standardized—each reporting agency has its own model and methodology. Some organizations weigh certain parts of the ESG analysis more heavily than others, so be sure to choose the organization that best aligns with your goals.

There are hundreds of ESG rating agencies throughout the world, and some of the more influential organizations are listed below.

ESG Rating Agencies:

Building a Genuine ESG Program

ESG scores are just the tip of the iceberg when it comes to developing a comprehensive ESG strategy. They can help leaders identify weak points in the strategy, strengths, and areas they should focus on next.

If you’re looking for strategies to boost ESG scores, consider the different pillars of ESG strategy and find initiatives that fit within those pillars. We’ve outlined some example strategies below.

Environmental:

- Install solar panels to aid in business operations

- Provide employees with benefits such as a Carbon Savings Account

- Identify areas of your supply chain where you can minimize the amount of waste or carbon emissions produced in your production process

Social:

- Implement diversity and inclusion programs into your workforce

- Ensure and enforce fair labor practices

- Provide employee with health and well-being initiatives

Governance:

- Push for more board diversity

- Implement transparent corporate governance policies

- Establish risk management processes and oversight practices

ESG Score FAQ

What does ESG stand for?

ESG stands for environmental, social, and governance. It’s a framework that organizations use to help maintain ethical business practices and stay accountable to the three pillars.

What is considered a low ESG score?

ESG scores can vary depending on the reporting methodology used. ESG scores are commonly ranked from 0 to 100, with 0 being low and 100 being high. Organizations that score 50 or below are deemed low, while anything 70 and above is considered high.

What is the problem with ESG scores?

ESG ratings can vary depending on which methodology an organization chooses to go with for review and analysis. Because of this, ESG scores are not consistent across different methodologies, which means there’s no set standard for what is considered “good” or “bad,” but performance can be estimated based on the numbers provided by your rating agency.

Minimize Scope 3 Emissions with Scope Zero

Provide employees with opportunities for financial wellness while minimizing Scope 3 emissions. Schedule a demo to learn how you can measure, reduce, and report Scope 3 work-from-home and commute emissions while reducing spend on sustainability goals.

Join our community

Sign up for our newsletter to stay up-to-date on all things Scope Zero.

Platform

Platform